A New Era of Demand ResponseMonday, August 24, 2015 reprinted from Power Engineering with permission of co-authors. Full text is at http://www.power-eng.com/articles/print/volume-119/issue-8/features/a-new-era-of-demand-response.html A New Era of Demand ResponseBlurring the Lines between Generation and Demand-Side ResourcesBy Stuart Schare and Brett FeldmanDemand Response (DR) capability in North America has grown considerably in the past five years, both at utilities and within competitive markets such as PJM. However, DR technologies and policies have generally relegated DR to a minor role as a last-called resource. DR has typically been slower to respond than combustion turbines, and the load relief it provides has been difficult to assess precisely (if at all) in the real-time operating environment in which control center staff operate. Furthermore, regulatory policies in support of DR have generally focused on the magnitude of megawatts achieved at the expense of the quality and usefulness of those megawatts. Slowly, but surely, this is changing. The use of DR in grid planning and operations has solidified as utilities increasingly rely on DR to meet installed capacity requirements and sometimes even operating reserve requirements. Furthermore, independent system operators (ISOs) led by PJM have incorporated DR into procurement mechanisms for capacity, energy, and ancillary services. Industry acceptance of DR as an integral part of the future grid continues to grow, with states like California and New York rolling out major regulatory initiatives and Hawaiian Electric issuing a request for proposals to DR aggregators for the provision of "grid services," including ancillary services, from demand-side resources. So which technologies and policies will drive DR into the future as a more integrated and valued resource?

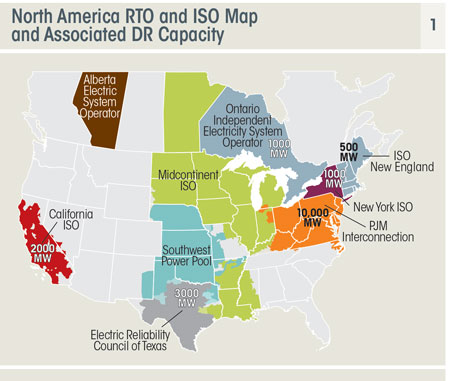

This article describes the current DR landscape in North America, including state and regional activities that uniquely affect how much DR is in place and how it is utilized. It covers some of the emerging DR technologies that are allowing DR to be viewed more on par with generators, and it reviews new applications of DR that are raising its prominence as a valued resource alternative for utilities and system operators. Looking ahead, emerging state policies and utility initiatives are driving DR to a heightened prominence that would have been difficult to envision just five years ago. DR in North AmericaDemand response is a term that can mean many different things to many different people. A common definition that traces back at least to a U.S. Department of Energy report nearly 10 years ago characterizes DR as changes (usually reductions) in electricity usage by end-use customers from their normal consumption patterns. What makes these consumption changes "demand response" is that they are in response to changes in the price of electricity or to direct incentives, typically at times of high wholesale market prices or when system reliability is jeopardized. Common examples of DR include direct load control of residential air conditioning, curtailment of commercial cooling and lighting loads by building operators participating in utility programs, and shutdown or deferral of industrial/manufacturing processes. An important distinction for DR is that it must be dispatchable by a utility or system operator, or be initiated by a customer in response to a non-fixed price signal. Thus, static time-of-use rates and scheduled thermal energy storage are not typically considered to be DR; but critical peak pricing-where the highest price tier is only in effect periodically as called by the utility or operator-is characterized as DR. Utility Program or Grid Resource?DR has matured from manual response to inflexible, interruptible industrial rates of a generation ago to the much more automated and customizable programs and products being offered today-with plenty of everything in between accounting for the bulk of current DR capacity in North America. An important distinction in characterizing DR activity is whether the curtailment capacity is part of a vertically integrated utility program or within a market defined by an independent system operator (ISO). Utility programs are typically based on a regulator-approved tariff, and offer a fixed incentive, or set of participation and incentive options, to eligible customers who voluntarily enroll in the programs. While voluntary, many programs have non-performance penalties or provisions for withholding incentives or removing customers from the programs. One of the most frequently used and long-standing programs is Florida Power & Light's (FPL) On Call Savings Program with more than 800,000 participants and well over 1,000 MW of central air conditioning curtailment capability. Xcel Energy in Minnesota and Colorado has a similar participation rate of over 20 percent of eligible customers. Other non-ISO utilities with significant residential DR programs include Duke Energy Carolinas, NV Energy, and PacifiCorp. Most investor-owned utilities also offer one or more rates or programs for commercial/industrial DR. DR programs tend to be more limited in ability than generators in that they are often only available when cooling loads are prominent, and they are commonly restricted to perhaps a dozen events per year of four to six hours in duration, often within a narrow window of eligible hours. DR in ISO marketsIn the United States and Canada, there are nine major Regional Transmission Organizations (RTO) and ISOs responsible for running wholesale electricity markets and managing a large transmission grid with high voltages. Some of these organizations have crafted DR programs or integrated DR into their market designs, thereby encouraging customer load participation. DR has matured in the electricity market and has been afforded the opportunity to bid directly against generation in these markets-commonly for capacity, but also for energy and ancillary services in some regions. Currently, there are approximately 30,000 MW of DR in North America, according to Navigant Research's recent Demand Response report, with a bit over half coming from the RTOs/ISOs. This is made up of about 8 million residential and commercial & industrial (C&I) customers. This market size equates to approximately $1.5 billion in DR revenues for DR providers and customers. PJM manages the largest DR market in the world, at approximately 10,000 MW. In some zones within the ISO, DR makes up more than 10 percent of the capacity resource base. PJM has also been a leader in making it possible for DR to participate and submit bids for reductions in the synchronized reserves and frequency regulation markets. However, there are some headwinds that may challenge the continued growth of DR in PJM markets, such as regulatory/legal challenges and increased operational requirements that limit compensation for DR that is not available 24 hours a day, year round. Until recently, punctuated by the grid demands of the 2014 Polar Vortex, most DR bid into PJM was only required to be available for ten six-hour events during summer months. Within the New York ISO footprint, the New York Public Service Commission is undertaking perhaps the most ambitious plan to date from a state looking to modernize its electric utility sector. Called Reforming the Energy Vision (REV), the initiative's goal is to transform the current utility model into a distribution system platform (DSP). The role of the DSP would be to lay the groundwork required for energy service providers on both the grid side and the customer side of the meter to provide products and services to enhance the distribution system's efficiency. Examples of these products and services include network sensors, distribution automation, DR, distributed generation, and microgrids. As part of the proceeding, utilities are required to develop their own DR programs as a supplement to or replacement of the NYISO DR programs. In California, the ISO (CAISO) is one of several bodies contributing to a "bifurcation" plan to split DR into supply-side and "load-modifying" resources. Essentially, this means is that price-based programs intended to shape loads will remain with the utilities, while programs focused on reliability, flexibility, and ancillary services will reside with CAISO. Furthermore, a stakeholder process is underway where all types of DR would be identified, as well as how they could play a part in California's electrical grid and what benefits they could provide. State policy is directing utilities to consider DR, not just generation, as a partner in planning how to balance and ensure reliability for the electric grid. Further, the California PUC is leading a process to value different types of DR for its ability to contribute to reliability, as well as to support the state's goals for reducing greenhouse gas (GHG) emissions. DR Vendors and Service ProvidersAs DR offerings and technologies have matured, an ecosystem of vendors has emerged with continually advancing hardware, controls, and head-end communications systems. Similarly, load curtailment "aggregators" have formed to recruit and enable customers to collectively deliver to utilities and ISOs DR capacity measured in the tens or hundreds of megawatts-or even more in some ISO markets. The DR market can be segmented from a vendor/aggregator perspective. On the C&I side, companies such as EnerNOC, CPower, and Johnson Controls specialize in one or more DR-related services including recruiting customers, automating rapid and reliable load response, and providing granular building usage data and performance diagnostics. The bulk of the mass-market segment includes single-family homes with central air conditioning and/or electric water heating, as well as small businesses with packaged units of 20 tons or less. As load control switches are nearly a commodity, and communicating "smart" thermostats are fast becoming the specialty domain of Nest and a variety of established and start-up companies, players in the mass market segment such as Comverge and Eaton (formerly Cooper Power Systems) specialize in one or more of the following: marketing/customer acquisition, head-end control systems, and communications between the customer and the service provider/utility (for example, Eaton offers a two-way mesh network dedicated to load control). A few vendors attempt to service all markets in the DR space. Honeywell is probably the best established, leveraging its experience in commercial building management as well as its thermostat hardware business and its 2010 acquisition of Akuacom, an early developer of open source Auto-DR software on the OpenADR platform. Other major players include Schneider Electric and Siemens, global companies attempting to develop differentiated services and acquire market share from those who have focused longer on the DR market. DR as a Grid Management ResourceIf DR is now well-established as a capacity resource that can provide emergency relief for reliability purposes, it has only recently begun making a name for itself as an operating resource to be used on a more regular basis for providing 10-minute operating reserves and other more precise ancillary services. Many of the core attributes describing combustion turbines and other generators have analogs for DR resources. For example, both generators and DR can be characterized by their megawatts of capacity and by the time it takes to bring those megawatts onto the grid. The real question is whether the performance of DR is comparable to generation-or at least whether DR can perform well enough compete and to provide a portion of the services required by grid operators. DR has been active in the synchronous reserves market in PJM for several years, providing up to 25% of the requirement at times. However, changes to the transmission system in 2013 dramatically lowered prices in this market and made it uneconomic for a lot of the DR to participate. These conditions may change in the future, so the technical capability is ready to jump in when prices warrant it. The frequency regulation market has shown signs of growth, particularly since PJM implemented FERC Order 755 which affords greater compensation to faster-responding resources. Several alternative resource providers, including batteries and DR, have begun bidding into the market and showing their ability to compete. A major driver for DR is the increasing penetration of intermittent renewable energy due to both regulatory mandates and improving economic and regulatory treatment of renewables.

Analogous Attributes between DR and Generation Resources

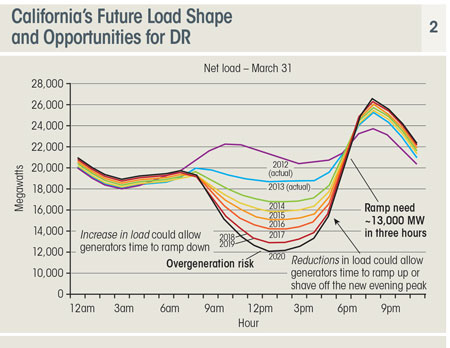

Resources like solar and wind power rely on natural elements that can sometimes be unpredictable and require backup power resources to respond quickly if clouds roll in or the wind stops blowing. Traditionally, this has been accomplished by having fossil power plants on standby or generating at below optimal levels. As the penetration of intermittent renewables increases, however, building generation just for this purpose may kill the business case for the renewable energy, so cheaper, more flexible backup alternatives must be considered. DR can help fill this void. California is perhaps the poster child for renewable energy inputs unsettling a grid. In 2013, CAISO constructed the now famous "duck chart," which shows the anticipated future load shape for the state in the shoulder seasons as solar becomes a larger part of the generation portfolio. The state will experience steeply declining net loads (customer demand minus customer-sited renewable generation) in the mid-to-late morning as solar production picks up, and even more dramatic increases in net load growth in the late afternoon as solar production drops off concurrent with an increase in residential loads. The new load shape provides opportunities for DR (as well as storage), especially in the late afternoons when load curtailment could slow-or at least help manage-the sharp ramp up. Alternatively, DR could be used to shave off some of the new evening peak. In the mornings when net load is in decline, DR can also help to balance the grid by soaking up excess supply as generators struggle to ramp down. Recall that DR is defined as "changes" in usage by end-use customers, but these changes don't always have to be reductions. An increase in demand-in response to an incentive or price signal-is also demand response. Some of the applications and technologies for DR as a down-ramping resource include over-cooling cold storage facilities and refrigerated warehouses, within acceptable limits of course. Essentially, the customers are using existing facilities and technologies for on-demand thermal storage. In this case, the benefit may be the ability to draw power from the grid, as well as the ability to tap into the stored energy at a later time to reduce demand from the grid.A newer and more innovative application of customer-sited thermal storage is grid-interactive water heating (GIWH). GIWH is the emerging consensus term for describing electric water heaters controlled by real-time, two-way communication with the utility, grid operator, or load aggregator. When equipped with grid-interactive controls, an electric water heater can respond to near real-time input by enabling fast up and down regulation and frequency control for the purpose of providing ancillary services and renewable storage to the utility or grid-operator. In addition to two way communication, GIHWs can measure and transmit information on water temperature, so grid operators know how much energy storage potential the fleet of GIWHs have at any given time; and based on customer usage patterns, they also can judge how much load curtailment, or regulation down service, the fleet can provide while still meeting customers' needs. Through the use of high-storage capacity, highly insulated water heater tanks, GIWH can provide even greater storage and operational capacity/flexibility than traditional water heaters that are simply retrofitted with interactive controls. The Future of DR in North AmericaIf DR is on a decades-long evolutionary path, will it continue to mature into an even more valuable grid resource on par with generation? Or will energy storage and the increasing demands for grid management in a world of high renewables penetrations squeeze DR out of the picture? State policies provide one indication of the future of DR, and these suggest a more integrated role for DR in resource planning and grid management-but with stricter requirements on how DR must perform. The days of rarely called interruptible rates and monthly capacity payments for the occasional 3-hour event may be in the past. The advent of grid modernization is tied to the new resiliency view on how the grid should be designed. States like California, Illinois, Maryland, New York, Massachusetts, and Hawaii have begun grid modernization proceedings to investigate how the future grid should look in terms of issues including metering and dynamic rates, distributed generation, and the associated implications transmission and distribution infrastructure. This modernization approach goes beyond siloed hearings on the individual aspects of utility operations to create a holistic structure for grid planning and payment formulas. DR may finally be able to compete on a level playing field, which could eliminate some current forms of DR while encouraging development of others. At the national level, a current FERC Supreme Court case has much bearing on the ability of DR to participate in wholesale markets in the United States. In early 2011, the FERC issued Order 745, which required wholesale energy markets to pay the same for DR as they do for electricity generation. Energy supplier and generation groups challenged the order in federal courts as unjust and unreasonable compensation. In May 2014, a panel of the U.S. Court of Appeals overturned the order by a 2-1 vote, potentially reverting things to how they were before-or making them worse, depending on interpretation. The majority opinion went even further and found that DR in the wholesale energy market is a retail transaction, which is outside of the FERC's jurisdiction. In December 2014, FERC asked the U.S. Supreme Court to review the case, which was granted, setting the stage for a hearing likely in early 2016. If the worst-case scenario plays out and DR is disallowed from all wholesale markets, states and utilities will have to fill the void. Depending on their status and disposition, this could take months to several years to enact. The short-term momentum of DR would be halted, but in the long term, if states and utilities assign higher value to DR than do the wholesale markets, it could lead to increased opportunities for DR. DR in the Energy CloudAside from government policy, the power sector is undergoing a fundamental transformation that could lead to an increase in DR capacity or how widely DR is used. Led by rooftop solar, encouraged by the prospect of cheap storage, and with the possibility of massive amounts of electric vehicles on the grid, the industry is slowly shifting away from a centralized hub-and-spoke grid architecture based on large centralized generation assets like fossil fuel, hydro, or nuclear power plants. The new paradigm-dubbed the Energy Cloud in a 2015 Navigant white paper-envisions an increasingly decentralized electrical grid that makes greater use of distributed energy resources, including DR. This change encompasses a diverse suite of technologies that includes energy storage, energy efficiency, DR, and the advanced software and hardware that enable greater control and interoperability across heterogeneous grid elements. These are all key components of the emerging energy cloud that is being accelerated by evolving regulation of carbon emissions, a more proactive consumer or prosumer, and the continuously improving financial viability of distributed resources compared to traditional generation. Navigant projects that there will be about 70,000 MW of DR in North America by 2023, an 11 percent annual growth rate. One indication of the growing prominence of DR and the vendors/service providers supporting it is the growth in membership of the leading DR trade association. The Peak Load Management Alliance (PLMA) has been in existence since 1999, yet just in the past three years had more than doubled in membership from less than 40 members to nearly 90 today. The recent setbacks and regulatory uncertainty in PJM-while interrupting DR's long-term trajectory-are an indication that the industry demands more responsiveness and accountability from DR resources. This will push the continued evolution to more fully automated, fast-responding, and controllable DR resources that are able to play an increasing role in integrating intermittent renewable energy and in managing real-time grid operations. Authors. Stuart Schare is a Managing Director of Energy at Navigant Consulting Inc. Brett Feldman serves as Senior Research Analyst at Navigant Consulting. |